Operating CanadaWide (except Quebec)

ACCIDENT

&

SICKNESS

ACCIDENT & SICKNESS INSURANCE

Better coverage than any Employer Benefits!!

Accident and sickness insurance, also known as disability insurance, plays a crucial role in providing financial protection to individuals who are unable to work due to unexpected injuries or illnesses. As an insurance advisor, it's important to understand the intricacies of accident and sickness insurance to effectively guide clients in selecting the right coverage for their needs. This insurance type pays you while you are living, hence it is also called Living Benefits Insurance.

Understanding the Coverage: Accident and sickness insurance typically provides income replacement benefits to policyholders who are unable to work due to covered accidents or illnesses. The coverage may vary depending on the policy, but it generally includes temporary or permanent disabilities resulting from accidents, injuries, or illnesses.

Types of Coverage:

1. Accident Coverage: This part of the policy provides benefits if the insured suffers an injury due to an accident, such as a car crash, fall, or sports-related injury.

2. Sickness Coverage: This aspect of the policy offers benefits for illnesses that prevent the insured from working, such as cancer, heart disease, or mental health conditions.

3. Short-Term Disability: Provides income replacement for a short duration, typically ranging from a few weeks to a few months.

4. Long-Term Disability: Offers income replacement for an extended period, often until retirement age, if the insured is unable to return to work due to a disability.

Benefits of Accident and Sickness Insurance:

1. Income Replacement: It ensures that individuals continue to receive a portion of their income if they are unable to work due to disability.

2. Financial Security: Helps policyholders cover daily expenses, mortgage or rent payments, medical bills, and other financial obligations during periods of disability.

3. Peace of Mind: Knowing that they have financial protection in place can provide peace of mind to individuals and their families, especially in uncertain times.

Factors to Consider When Choosing a Policy:

1. Coverage Limits: Understand the maximum benefit amount the policy will pay out and whether it's sufficient to cover living expenses.

2. Waiting Period: Determine how long the insured must wait before benefits kick in after the onset of disability. Shorter waiting periods may result in higher premiums.

3. Definition of Disability: Pay attention to how disability is defined in the policy. Some policies may have stricter definitions that make it harder to qualify for benefits.

4. Premiums: Consider the affordability of premiums, but also weigh them against the level of coverage provided.

Customization Options: Depending on the insurance provider, clients may have the option to customize their accident and sickness insurance policy to suit their specific needs. This could include adding riders for additional coverage or adjusting benefit amounts and waiting periods.

Claims Process: As an advisor, it's crucial to educate clients about the claims process and help them understand what documentation and evidence they may need to provide to file a successful claim. Additionally, assist them in reviewing their policy regularly to ensure it still meets their needs as circumstances change.

Complementary Coverage: Accident and sickness insurance can complement other forms of insurance coverage, such as health insurance and life insurance. By having a comprehensive insurance portfolio, individuals can better protect themselves and their families against unforeseen financial hardships.

Education and Communication: Lastly, as an insurance advisor, it's essential to educate clients about the importance of accident and sickness insurance and communicate clearly about policy terms, coverage limitations, and potential exclusions. Empowering clients with knowledge enables them to make informed decisions about their insurance needs.

In conclusion, accident and sickness insurance is a vital component of financial planning, providing essential protection against the financial consequences of unexpected disabilities. As an insurance advisor, it's your responsibility to guide clients through the process of selecting the right coverage and ensuring they understand the benefits and limitations of their policy.

Accident and sickness insurance, also known as disability insurance, plays a crucial role in providing financial protection to individuals who are unable to work due to unexpected injuries or illnesses. As an insurance advisor, it's important to understand the intricacies of accident and sickness insurance to effectively guide clients in selecting the right coverage for their needs. This insurance type pays you while you are living, hence it is also called Living Benefits Insurance.

Understanding the Coverage: Accident and sickness insurance typically provides income replacement benefits to policyholders who are unable to work due to covered accidents or illnesses. The coverage may vary depending on the policy, but it generally includes temporary or permanent disabilities resulting from accidents, injuries, or illnesses.

Types of Coverage:

1. Accident Coverage: This part of the policy provides benefits if the insured suffers an injury due to an accident, such as a car crash, fall, or sports-related injury.

2. Sickness Coverage: This aspect of the policy offers benefits for illnesses that prevent the insured from working, such as cancer, heart disease, or mental health conditions.

3. Short-Term Disability: Provides income replacement for a short duration, typically ranging from a few weeks to a few months.

4. Long-Term Disability: Offers income replacement for an extended period, often until retirement age, if the insured is unable to return to work due to a disability.

Benefits of Accident and Sickness Insurance:

1. Income Replacement: It ensures that individuals continue to receive a portion of their income if they are unable to work due to disability.

2. Financial Security: Helps policyholders cover daily expenses, mortgage or rent payments, medical bills, and other financial obligations during periods of disability.

3. Peace of Mind: Knowing that they have financial protection in place can provide peace of mind to individuals and their families, especially in uncertain times.

Factors to Consider When Choosing a Policy:

1. Coverage Limits: Understand the maximum benefit amount the policy will pay out and whether it's sufficient to cover living expenses.

2. Waiting Period: Determine how long the insured must wait before benefits kick in after the onset of disability. Shorter waiting periods may result in higher premiums.

3. Definition of Disability: Pay attention to how disability is defined in the policy. Some policies may have stricter definitions that make it harder to qualify for benefits.

4. Premiums: Consider the affordability of premiums, but also weigh them against the level of coverage provided.

Customization Options: Depending on the insurance provider, clients may have the option to customize their accident and sickness insurance policy to suit their specific needs. This could include adding riders for additional coverage or adjusting benefit amounts and waiting periods.

Claims Process: As an advisor, it's crucial to educate clients about the claims process and help them understand what documentation and evidence they may need to provide to file a successful claim. Additionally, assist them in reviewing their policy regularly to ensure it still meets their needs as circumstances change.

Complementary Coverage: Accident and sickness insurance can complement other forms of insurance coverage, such as health insurance and life insurance. By having a comprehensive insurance portfolio, individuals can better protect themselves and their families against unforeseen financial hardships.

Education and Communication: Lastly, as an insurance advisor, it's essential to educate clients about the importance of accident and sickness insurance and communicate clearly about policy terms, coverage limitations, and potential exclusions. Empowering clients with knowledge enables them to make informed decisions about their insurance needs.

In conclusion, accident and sickness insurance is a vital component of financial planning, providing essential protection against the financial consequences of unexpected disabilities. As an insurance advisor, it's your responsibility to guide clients through the process of selecting the right coverage and ensuring they understand the benefits and limitations of their policy.

ACCIDENT & SICKNESS INSURANCE BENEFITS

Getting paid daily in the case of accident and sickness insurance typically involves a specific type of coverage known as daily or weekly indemnity benefits. Here's how it works:

Understanding Daily Indemnity Benefits: Some accident and sickness insurance policies offer daily or weekly indemnity benefits, which provide a fixed amount of money for each day or week that the insured is unable to work due to a covered accident or sickness. These benefits are designed to provide immediate financial support to help cover ongoing expenses during the period of disability.

Policy Coverage Details: To get paid daily under this type of insurance, the policyholder must first have a policy that includes daily indemnity benefits. The coverage details, including the daily benefit amount and maximum duration of benefits, will be outlined in the policy contract. It's important for individuals to review their policy carefully to understand the terms and conditions of their coverage.

Filing a Claim: If the insured suffers an injury or illness that prevents them from working, they must file a claim with their insurance provider to receive daily indemnity benefits. This typically involves submitting documentation, such as medical records or a doctor's statement, to verify the disability and its impact on the insured's ability to work.

Approval and Payment Process: Once the claim is filed, the insurance provider will review the documentation to determine eligibility for benefits. If the claim is approved, the insured will begin receiving daily or weekly indemnity payments according to the terms of their policy. Payments may be made through direct deposit or by check, depending on the insurer's policies.

Duration of Benefits: Daily indemnity benefits are typically payable for a limited duration, such as a certain number of days or weeks, as specified in the policy. The insured will continue to receive payments until they recover from their disability, reach the maximum benefit period, or until other policy limitations are met.

Coordination with Other Benefits: It's important to note that daily indemnity benefits may coordinate with other sources of income replacement, such as sick leave benefits from an employer or disability benefits from government programs like Social Security Disability Insurance (SSDI). The total amount of benefits received cannot exceed the insured's pre-disability income.

Policy Exclusions and Limitations: Like any insurance coverage, daily indemnity benefits may have exclusions and limitations that determine when benefits are payable. For example, benefits may not be provided for disabilities resulting from certain pre-existing conditions or injuries sustained under specific circumstances. It's essential for individuals to understand these exclusions and limitations when purchasing a policy.

Overall, getting paid daily in the case of accident and sickness insurance involves having a policy that includes daily indemnity benefits, filing a claim with the insurance provider, and meeting the eligibility criteria outlined in the policy contract. By understanding the coverage details and following the claims process, individuals can access the financial support they need during periods of disability.

Getting paid daily in the case of accident and sickness insurance typically involves a specific type of coverage known as daily or weekly indemnity benefits. Here's how it works:

Understanding Daily Indemnity Benefits: Some accident and sickness insurance policies offer daily or weekly indemnity benefits, which provide a fixed amount of money for each day or week that the insured is unable to work due to a covered accident or sickness. These benefits are designed to provide immediate financial support to help cover ongoing expenses during the period of disability.

Policy Coverage Details: To get paid daily under this type of insurance, the policyholder must first have a policy that includes daily indemnity benefits. The coverage details, including the daily benefit amount and maximum duration of benefits, will be outlined in the policy contract. It's important for individuals to review their policy carefully to understand the terms and conditions of their coverage.

Filing a Claim: If the insured suffers an injury or illness that prevents them from working, they must file a claim with their insurance provider to receive daily indemnity benefits. This typically involves submitting documentation, such as medical records or a doctor's statement, to verify the disability and its impact on the insured's ability to work.

Approval and Payment Process: Once the claim is filed, the insurance provider will review the documentation to determine eligibility for benefits. If the claim is approved, the insured will begin receiving daily or weekly indemnity payments according to the terms of their policy. Payments may be made through direct deposit or by check, depending on the insurer's policies.

Duration of Benefits: Daily indemnity benefits are typically payable for a limited duration, such as a certain number of days or weeks, as specified in the policy. The insured will continue to receive payments until they recover from their disability, reach the maximum benefit period, or until other policy limitations are met.

Coordination with Other Benefits: It's important to note that daily indemnity benefits may coordinate with other sources of income replacement, such as sick leave benefits from an employer or disability benefits from government programs like Social Security Disability Insurance (SSDI). The total amount of benefits received cannot exceed the insured's pre-disability income.

Policy Exclusions and Limitations: Like any insurance coverage, daily indemnity benefits may have exclusions and limitations that determine when benefits are payable. For example, benefits may not be provided for disabilities resulting from certain pre-existing conditions or injuries sustained under specific circumstances. It's essential for individuals to understand these exclusions and limitations when purchasing a policy.

Overall, getting paid daily in the case of accident and sickness insurance involves having a policy that includes daily indemnity benefits, filing a claim with the insurance provider, and meeting the eligibility criteria outlined in the policy contract. By understanding the coverage details and following the claims process, individuals can access the financial support they need during periods of disability.

DIFFERENT DAILY BENEFITS - ACCIDENT

$100

$200

$300

$400

$500

DIFFERENT DAILY BENEFITS - SICKNESS

$100

$200

$300

$400

$500

Living Benefits Insurance Pays Independently & on Top of

Life Insurance

Critical Illness

WSIB

EI

OHIP

Auto Insurance

Mortgage Insurance

Home Insurance

Group Benefits

Credit Card Ins

Liability Insurance

Business Insurance

Content Insurance

What all does Living Benefits Insurance Covers

Hospitalization

Travel

Parking

Prescriptions

Meals

ICU

Doctor Visits

Physio Visits

Nurse Visits

Baby Sitter

Home Care

Snow Removal

Land Scaping

Utilities

Rent

Natural Accidents

Auto Accidents

Common Carrier Accidents

Auto Accidents

Natural Accidents

Common Carrier Accidents

Mortgage Payments

Lost Paid Time of Work

Recovery Period post any Hospitalization

Recovery Benefit post any Outpatient Surgery

Guaranteed Renewals until age 85

Mortgage Payments

Lost Paid Time of Work

Recovery Benefit post any Outpatient Surgery

Recovery Period post any Hospitalization

Guaranteed Renewals

until age 85

PREMIUMS FOR

Single Person

Family

PREMIUMS FOR

Single

Starting from $0.5/day to $1.9/day

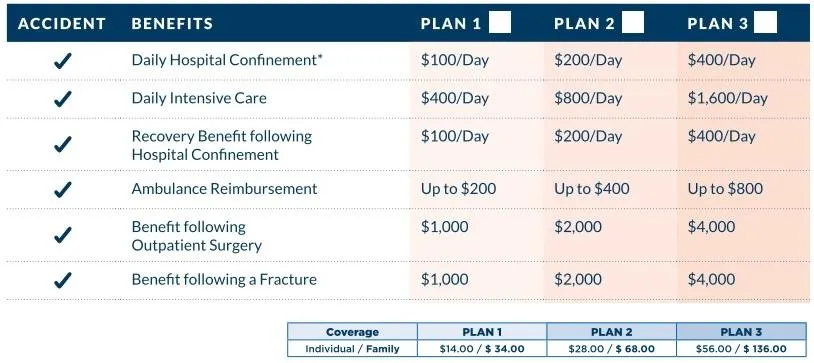

Single Person Coverage: Monthly $14 , $28 & $56 Plan

Starting from $1.2/day to $4.5/day

Family coverage covers parents & all children!

Monthly $34 , $68 & $136 Plan

Premiums Starting from $0.5/day to $1.9/day

Family

Premiums Starting from $1.2/day to $4.5/day

Family coverage covers parents & all children!

Get in touch with me using the WhatsApp Icon on bottom right of this page

Proudly working 100% remotely in Canada, Post COVID-19

@ Consultant Manpreet. All Rights Reserved 2020.